At 8pm ET tonight I’ll do a livestream review of the WWE earnings report exclusively for patrons at patreon.com/wrestlenomics. Video and audio will also be available for patrons on-demand afterward.

This article will be updated periodically after 4pm ET with the latest live coverage of WWE’s Q1 earnings report today.

Read the WWE Q1 2021 Earnings Report Estimate and Preview posted earlier today.

The earnings conference call will be streamed live at 5pm ET at corporate.wwe.com. The earnings report and other information is expected to be available on the site as well.

You may also follow along with this tweet thread.

Earnings press release: https://corporate.wwe.com/investors/news/press-releases/2021/04-22-2021-211046456

Trending schedules: https://corporate.wwe.com/~/media/Files/W/WWE/press-releases/2021/q1-2021-trending-schedules.pdf

Key Performance Indicators:

WWE reports Q1 2021 net income of $43.8 million. That means an EPS of $0.51 per share, more than doubling expectations.

Revenue for the quarter is $263.5 million, a few million over expectations.

On profitability, WWE writes that “upfront revenue recognition related to the delivery of certain WWE Network intellectual property rights was partially offset by the absence of a large-scale international event.” The former likely refers to peacock, the latter, KSA events.

WWE resumed its stock buyback program in Q1, buying $75.0 million work of shares, intended to return value to shareholders. “WWE intends to continue opportunistic repurchases under the program.” The program had been paused early in the pandemic.

Online media consumption is up sequentially but down from last year’s Q1, new KPIs show. In Q1 2021 fans watched 367 million minutes of online video.

This measures video viewing across Facebook, Instagram, Snapchat, TikTok, Twitch, Twitter, YouTube, as well as WWE platforms.

It’s notable that the slide that in the past would be updated with a count of WWE Network subscribers domestically and internationally is gone from the KPIs. It’s possible international subs are disclosed in the 10-Q, but who knows.

p. 3 of WWE’s trending schedules shows the most granular look at WWE’s finances the company discloses.

There was huge growth in the Network segment, coinciding with the beginning of the Peacock deal in March. Year 1 of the deal is probably front-loaded.

WWE’s social media KPI slide shows huge, unusual growth in Facebook followers. Meanwhile Twitter followers were down 3 million.

For what it’s worth, these numbers include all talent and brand social media accounts. It’s not a representation of unique followers.

I don’t get CNBC on Sling, sadly. I’m hearing CFO Kristina Salen is appearing on the network right now.

Revenue for the Consumer Products segments was up from Q1 2020 despite no venue merchandise. Online merchandise sales were compared to recent quarters since the pandemic, with 10 million in sales. Product licensing was up to $11 million, higher than the last two Q1s.

The more detailed quarterly report (10-Q) has just been released:

p. 7 of the 10-Q further confirms, not that there was any doubt, that this quarter included upfront payments from NBCU related to the new Peacock agreement for WWE Network content.

Doing a quick search of the 10-Q there doesn’t appear to be any international subscriber counts published in the document. Unless I’ve missed something the era of tracking WWE Network subscribers appears to be over.

The webcast link for the conference call, beginning at the top of the hour is here. Anyone should be able to register and listen:

Media operating expenses (including the cost of the Thunderdome) for the quarter was $123.9 million. That’s down from Q1 2020, which included a Saudi event.

In Q1 2019, that number was just $98.5 million, although at that time there was still a Monday-Tuesday TV schedule.

The investor presentation is now available.

It’s pretty nondescript. Some column charts with financial highlights that Salen will probably go over.

The conference call should beginning any minute with comments from Vince McMahon, Stephanie McMahon, Nick Khan, and Kristina Salen.

I will tweet notes of their comments and try to paraphrase best I can. These tweets are not necessarily direct quotes.

WWE shares are up 3% currently in after hours trading, probably due the company overperforming stock analysts expectations on profitability for the quarter.

The call is beginning. SVP Michael Weitz begins the call as always with a welcome and introduction of the executives, and reading of disclaimers.

He hands the call off to Vince McMahon.

Regarding Covid, Vince says, at first WWE was in survival mode but then we found a way… We saw this as an opportunity to open a “treasure chest”. He praises the leadership team.

After short remarks he hands it over to Nick Khan.

Khan says he’ll discuss new developments in media industry and then will give an update about programming and live events.

Khan talks about the increases in sports rights fees for NFL and NHL from new deals. He points out that’s despite NHL linear ratings being down.

One of the big takeaways is the media networks are paying to license linear and streaming rights. The days of splitting those rights days are over, Khan says.

These companies view live rights as key for attracting and retaining subscriptions for streaming platforms.

Wrestlemania was distributed on Peacock in the U.S. for the first time. “We were thrilled with the result” and NBCU was even happier, Khan says.

We’re excited about possibility replicating the Peacock deal in key international eras.

Content rights aren’t the only focus. On April 10, WWE dropped its first NFT featuring the Undertaker. Many sold out in seconds. We were thrilled with our first foray into the space. Look for more NFTs in the future, Khan says.

Khan discusses WWE Studios output. A new deal Crunchy Roll, Young Rock on NBC, Stone Cold biography on A&E.

He turns the call over to Stephanie McMahon.

Stephanie says Wrestlemania attracted more than 50,000 fans. She describes the even in glowing terms. “The power of belonging”.

(My note: Tampa Sports Authority records show there were just under 40,000 fans at the stadium for both nights combined.)

Stephanie says Wrestlemania on Peacock was a success. She says Wrestlemania media coverage increased 25%, representing 1.2 billion media impressions.

A list of musicians and celebrities who appeared on Wrestlemania are mentioned. Bianca Belair is also mentioned.

WWE had 14 new and returning blue chip sponsors for Wrestlemania, Stephanie says.

Video views hit 1.1 billion and 32 million hours of content were consumed. Represented a 14% and 19% increase, respectively.

Raw delivered its best P18-49 performance in over a year, Stephanie says. (My note: Showbuzz data confirms this is accurate.)

TV viewership continued to remain stable, maintaining a trends since WWE entered the Thunderdome.

Raw ratings hold steady and Smackdown ratings increased 9%. Appearances of Bad Bunny during Raw led to an 31% increase in Hispanic audiences, Stephanie says.

It clear once again “large-scale international event” is code for Saudi Arabia events.

She turns over to CFO Kristina Salen.

Salen was awed by the WWE team at Wrestlemania.

She’s now discussing this slide from the investor presentation.

“We did achieve some efficiency quarter-over-quarter,” Salen says about expenses related to Thunderdome production.

Salen summarizes live events business since Covid, referring to this slide.

Predicting the pace of that return of live events is challenging. WWE doesn’t anticipate the return of live events until at least the second-half of 2021, Salen says.

Now on to the third major business division, Consumer Products.

WWE was the #1 action figure sold at Walmart, Salen says.

WWE has a ton of cash on hand (my words). Salen mentions that WWE resumed its stock buyback program in order to return value to shareholders.

WWE is maintaining its previous full year guidance of $270 million to $305 million in adjusted OIBDA, due uncertainty related to live events, including “large scale international events”.

Salen finishes her comments and the line is being opened for Q&A with stock analysts.

Curry Baker asks about sponsors. WWE is undermonetized relative to live sports. Can we get insight on inventory for Peacock deal. What’s the size of the opportunity over the next few years?

Khan defers to Stephanie who agree that there’s an huge opportunity. She puts over how there’s an ease of doing business with WWE because of superstars.

Launching product on Peacock was the priority, Khan says. Further monetizing it is next.

Baker asks about the lift WWE expects in ratings in the second-half of the year. Anything new on storylines or talent that you think might reenergize the fanbase?

Khan jokes we have a 4 question limit per person. He says with ratings “it’s the culmination of everything.”

“Eyeballs are going away from” linear, Khan says, downplaying declines in linear TV viewership. WWE numbers are “robust”.

The fans are our fourth wall, Khan says. We think the return of fans is going to have a direct positive impact on all parts of our business.

Brandon Ross asks Khan to size “record viewership” of WWE on Peacock.

Peacock has asked WWE not to disclose numbers, Khan says. WWE woke up to calls and emails from Peacock, which usually means they’re thrilled. Many of us heard from them Sunday night and Monday morning.

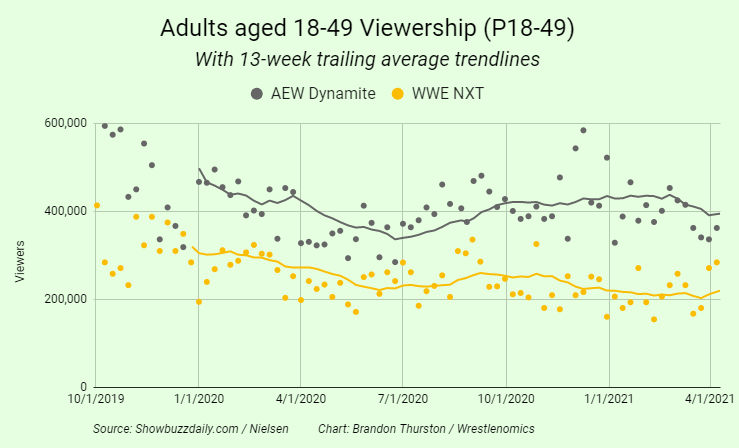

Ross asks about NXT moving nights to Tuesday. How did you weigh that move. “It appears AEW is reaching record viewership … Do you think about them? Do you care?” Ross asks.

Khan says everything is competition. All we’re focused on is attracting eyeballs to our content.

Khan brings up NHL and says he believes NBC and NHL will not continue to be in business together, so that had no effect on the decision to move NXT.

“We’re pleased with the increase in NXT ratings and not focused on anyone other than ourselves.”

Ross asks if there’s other players besides Amazon in the big tech company world that will be suitors for content like WWE.

Khan thinks Apple is working on something and WWE is seeing what they’re moves are going to be. “We know live matters, and that’s what we do.”

Laura Martin asks if WWE can actually sell rights to content during the term of their current U.S. agreements.

Khan mentions international opportunities and says that in terms of the existing content in the U.S., that’s licensed through October 2025.

Salen takes a question on opex. When we’ve discussed TV production on a per episode basis. It’s now up 30% year-over-year, she says. While it’s up, QOQ we were able to make Thunderdome more efficient.

Eric Katz from Wolfe Research asks if WWE would hold a residency while phasing in touring. Is the return “full bore” or a phase-in.

Salen says WWE hasn’t decided yet what their plans will be. Their hope is that they will return to full touring, not phase-in.

Salen adds that the current guidance assumes the return of full touring in the second-half of 2021.

David Karnovsky from JPMorgan brings up increase demand for live content. Will some sports like NFL or WWE disproportionately benefit?

Khan says there’s only so much money to go around. New content will have more challenges. SEC college football is in great shape. Khan looks for some kind of consolidation school or conference wise.

Salen takes a question on eCommerce. She brings up the launching of new title belts, the launch of legends and how enthusiastic fans are about legendary WWE superstars. We’ve been doing a lot to get folks to come to eCommerce and stay.

Ben Swinburne with Morgan Stanley asks if we’ve seen all the revenue recognition of one-time assets, or is there more in Q2? On NFTs, what’s the opportunity there?

Salen says yes it’s largely done. Some one-time revenue around marquee shows, but nothing like the size of Q1.

Khan jokes “we remain undefeated against the weather” regarding Wrestlemania.

On NFTs, Khan says owning IP is something WWE will be in long-term. 100 limited Undertaker cards sold out in 5 seconds. “These are the baseball cards of the digital world.”

Vasily Karasyov asks about the status of the global localization strategy that was rolled out by Paul Levesque in 2018.

Khan says no plans have not changed. They’ve just been delayed by Covid. Khan brings up the Superstar Spectacular for the India market earlier this year.

Weitz says they have time for one more question. Steven Cahall asks if Peacock delivery in Q1 outperformed their expectations and about how NXT TV rights performed compared to expectations.

Salen says there’s no change with impact to full year guidance for Peacock deal.

On NXT, Salen says it’s still within guidance range. They’re really pleased with the result but nothing to update on guidance due to NXT’s new TV deal (going into effect Q4 2021).

The call has ended. Thanks for following along.

Tonight at 8pm, I’ll do a live stream review of the earnings report for patrons only. Link here for current patrons or signup for just $5/month and get access to the massive viewership spreadsheet and more.

Originally tweeted by Brandon Thurston (@BrandonThurston) on April 22, 2021.

Brandon Thurston has written about wrestling business since 2015. He’s also worked as an independent wrestler and trainer.

This article is available for everyone because of support from our subscribers.

![]() START YOUR 7-DAY FREE TRIAL NOW

START YOUR 7-DAY FREE TRIAL NOW

Support quality reporting on the wrestling business

You must be logged in to post a comment.