Tomorrow is WWE’s Q2 (April to June 2021) earnings report after the close of the market with conference call at 5pm ET. Executives including CEO and chairman Vince McMahon, president and chief revenue Officer Nick Khan, chief brand officer Stephanie McMahon, and chief financial officer Kristina Salen are expected to make comments.

The average analyst estimates a $0.25 earnings per share ratio, according to the Wall Street Journal, which means about $21 million in net income for the quarter.

$252 million for the quarter is expected for revenue, according to Yahoo! Finance.

Before looking at those estimates, I (not a stock analyst) ran an estimate and came up with $27.5 million in net income for the quarter, higher than any stock analyst’s estimate I’ve seen. My revenue estimate is on the high end compared to analyst estimates, at $261 million.

One of the more uncertain factors in the model is anticipating what revenue WWE will get in the “Network” line in the first full quarter under the Peacock deal after getting bigger upfront payments related to transition from the WWE Network in Q1.

I modeled $49 million (plus about $13 million in international revenue) based on Year 1 of presumed escalating payments from Peacock at a reported $1 billion over five years ($200 million average per year).

Thanks to Wrestlemania, WWE will have significant live event revenue to report for the first time since Q1 2020.

Gate receipts showed $6.2 million in revenue related to the two-day event at Raymond James Stadium. There were no other live events in Q2.

WWE executives might give clarity on whether there’s a “large-scale international event” (they won’t say “Saudi Arabia”) in the works. Andrew Zarian and John Pollock have heard October 21 as a return date, which would be in Q4.

Each event in service of the KSA government is worth at least $50 million to WWE. For context that’s 3x a typical pre-Covid Wrestlemania gate and more than one year of TV payments from Turner to AEW.

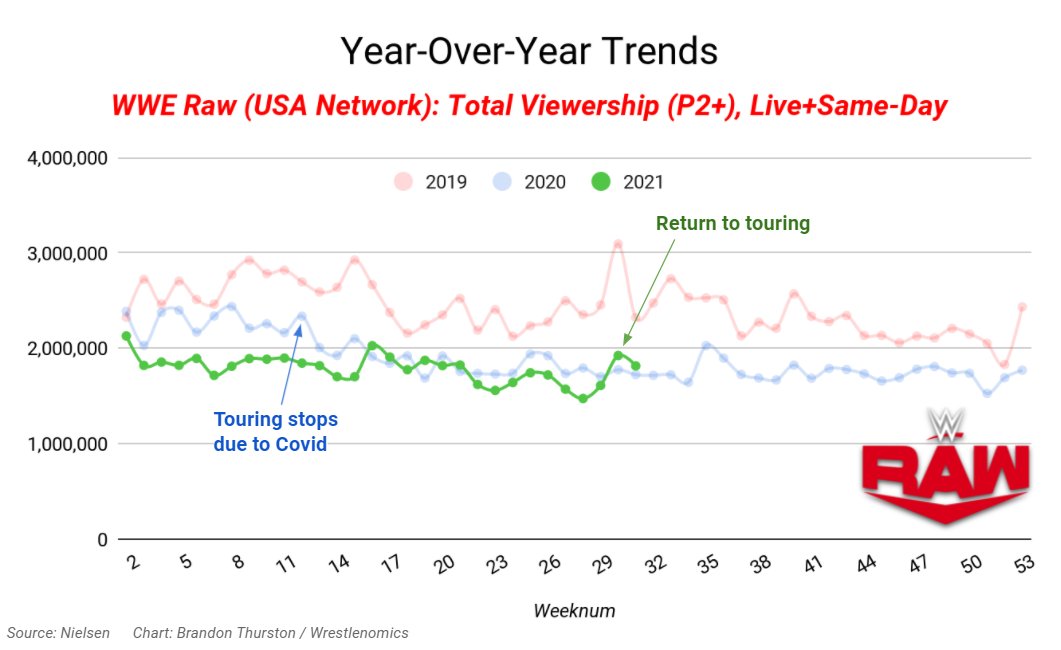

Expect much discussion of WWE’s return to touring and how that’s affected not just ticket revenues, but, more importantly, TV ratings. There have now been two Raws and Smackdowns back on the road.

Recent live event attendance and TV ratings trends

Ratings during this two-week period are better than when viewership bottomed out in July 2020, but will those increases sustain?

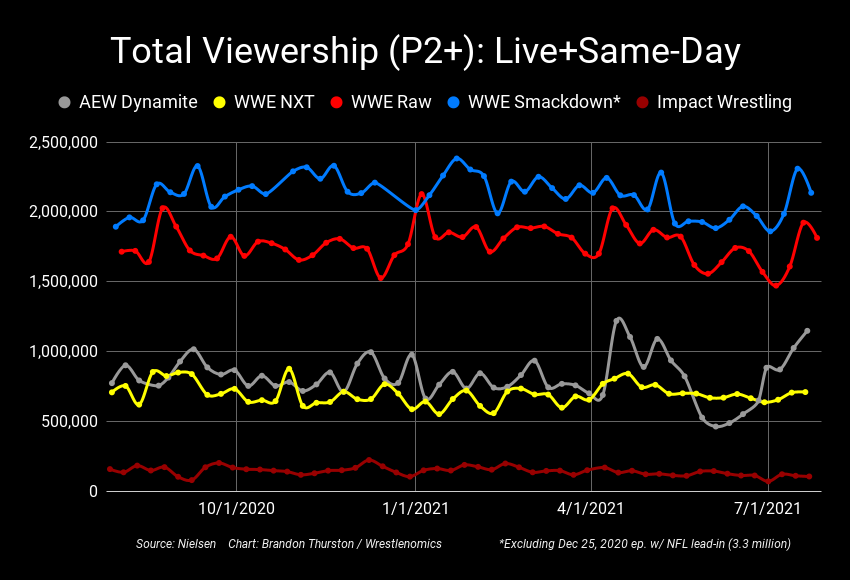

Wrestling fans can expect any mention of AEW from stock analyst Q&A to be met with a “we’re focused on us” talking point.

Last 365 days: total (P2+) and P18-49 viewership for AEW Dynamite, WWE NXT, WWE Raw, WWE Smackdown, and Impact Wrestling

What else will we learn? Lately Nick Khan, who does most of the talking on the calls lately, has regaled listeners with insights on the media business. Last call he said NBCU and the NHL would part ways before that was public knowledge.

Will there be hints about next-day rights for Raw and Smackdown currently held by Hulu? That deal expires in 2022 and there’s said to be increased interest since the last time that deal was made in 2018.

Will Nick Khan give an update on his thoughts on whether Amazon, Apple or other new players might have interest in WWE content rights?

Is current Smackdown rights holder Fox comfortable with its partner promoting Peacock and delivering viewership hovering around 2 million?

As usual, I’ll live tweet information from WWE’s newly published documents and from the conference call.

We’ll do a special Wrestlenomics podcast on Thursday night after the call for subscribers at http://patreon.com/wrestlenomics.

Disclaimer: I do not and have not in the past held any stock positions or ownership in World Wrestling Entertainment, Inc. (NYSE: WWE) or any wrestling companies. I have no plans to initiate any such positions.

Wrestlenomics content does not constitute investment advice and should not be construed as investment research.

Brandon Thurston has written about wrestling business since 2015. He’s also worked as an independent wrestler and trainer.

This article is available for everyone because of support from our subscribers.

![]() START YOUR 7-DAY FREE TRIAL NOW

START YOUR 7-DAY FREE TRIAL NOW

Support quality reporting on the wrestling business

You must be logged in to post a comment.